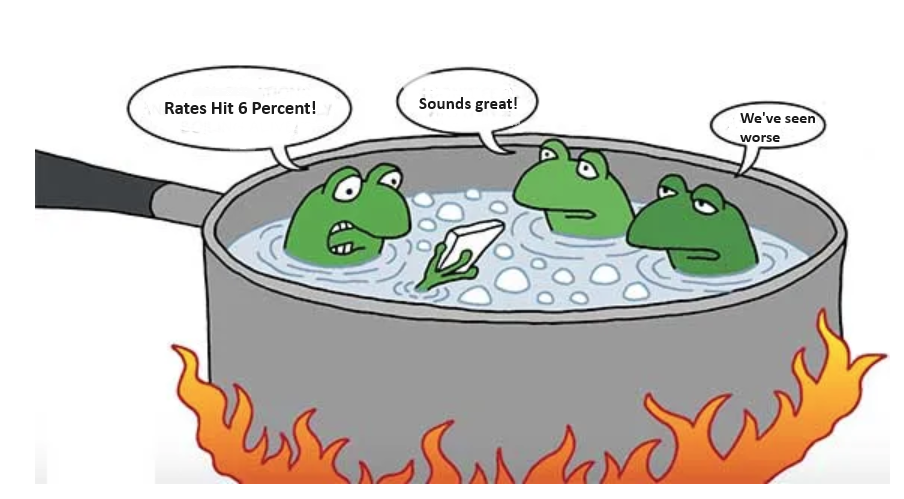

A frog in a tank of gradually boiled water, they say, will become inured to the rising temperature—until it eventually kills him.

What if you stop stoking the heat and maybe crank it down a notch or two?

I figure the frog learns to live with the discomfort. Maybe even starts to enjoy it.

The frog may say, “Now this really isn’t so bad.”

“It was worse a while ago.”

“What was I all freaked out about?”

That situation is coming in real estate in 2024.

Two years ago, mortgage interest rates were around 3 percent. They rose steadily and topped 8 in October 2023, and have since backed down a bit.

They will fall further in 2024, say a lot of experts. Economist Lawrence Yun of the National Association of Realtors is forecasting rates between 6 and 7 percent by spring of 2024.

When that happens, “all hell’s going to break loose,” said Barbara Corcoran, a national real estate expert who appears on the TV show “Shark Tank.” Housing prices “are going to go through the roof.”

Many local thought leaders have been saying the same thing. When rates fall, home buying anxiety will shrink and there will be a feeding frenzy reminiscent of 2021 and 2022.

“This isn’t so terrible,” will be a common refrain. “We’ve seen a lot worse.”

—

The pent-up demand to buy, one would hope, will be met with an increasing supply of homes for sale. Because sellers too have been immobilized in the recent, frozen market.

But many say sellers will be slower to respond. Their golden handcuffs—those low, locked-in mortgage rates—will continue to restrict supply.

Barbara Corcoran: “All hell’s going to break loose.”

Scarcity will persist and, perhaps sadly, home prices will rise further. That will be bad for buyers but mitigated somewhat by interest rates better than what they’ve seen.

Virtually no one is talking about lower prices in Denver, in any likely near-term scenario. Slower growth, yes. But mark-to-market declines, no.

How should buyers swim in this shark tank?

—

One possible response has become a familiar mantra: Marry the house, date the rate.

The thinking is that while a property purchase is permanent, financing is fluid. A loan today can be refinanced tomorrow.

I am personally put off by this metaphor. Are we to be married and dating at the same time?

That aside, a refi isn’t always so easy. Not if your credit or employment picture has changed. Not if your home value has dropped. And the refi will reset your amortization clock, and there will be fees and costs.

On the final point, some lenders have a solution. If you refinance, they will forgive certain closing costs such as the loan origination and processing fees. The new appraisal, however, will still cost money.

—

To buy or not to buy–that is the question. I mean to buy now, at today’s interest rates. This video compares two scenarios.

In Plan A, you take the plunge and buy today at $500,000 with 3.5 percent down. Your rate is 7.5 percent. Your monthly principal and interest costs are $3,374. Let’s project modest annual appreciation of 3 percent. After two years, the property is worth $530,000.

In Plan B, you wait around for the rates to drop. And they do, but it takes two years. The prevailing rates are then around 6 percent. You finally buy the house you were eyeing a couple of years ago. But it is now listed at $530,000. Your down payment is 3.5 percent and monthly principal and interest are $3,066.

So terrific. With the lower payment in Plan B, you’ll be saving $308 per month. Let’s even be charitable and say that monthly amount constituted a “savings” during the two years you waited. It adds up to $7,392. (But we must adjust the total savings downward by $1,050, with Plan B’s larger down payment.)

—

It doesn’t take a math genius to see that a savings of six or seven grand is peanuts compared to $30,000 in price appreciation. Going forward in Plan A, you can lower the interest costs by refinancing.

Yes, these scenarios include some speculation. And the recent unicorn years are a thing of the past. We may not soon see the sort of double-digit appreciation experienced in 2020 and 2021.

(Then again, see “feeding frenzy,” above.)

Still, historically, Denver real estate has appreciated by an average of around 6 percent annually for the past 50 years. They’re a much greater contributor to wealth than mortgage interest rates.

If you’re a prospective buyer, where do you want to be when all hell breaks loose? Maybe don’t wait for the frogs to stop fretting.

Do something now. Consider homes you might buy if the debt service costs were to drop by 20 percent. Some say they are about to.