A great shift in financial circumstances is afoot, heavily affecting people of millennial age and younger. The oldest millennials are now 42.

It is not a welcome shift. It is about the shrinking of wealth-building opportunities that have benefited past generations, including baby boomers like me, for decades,

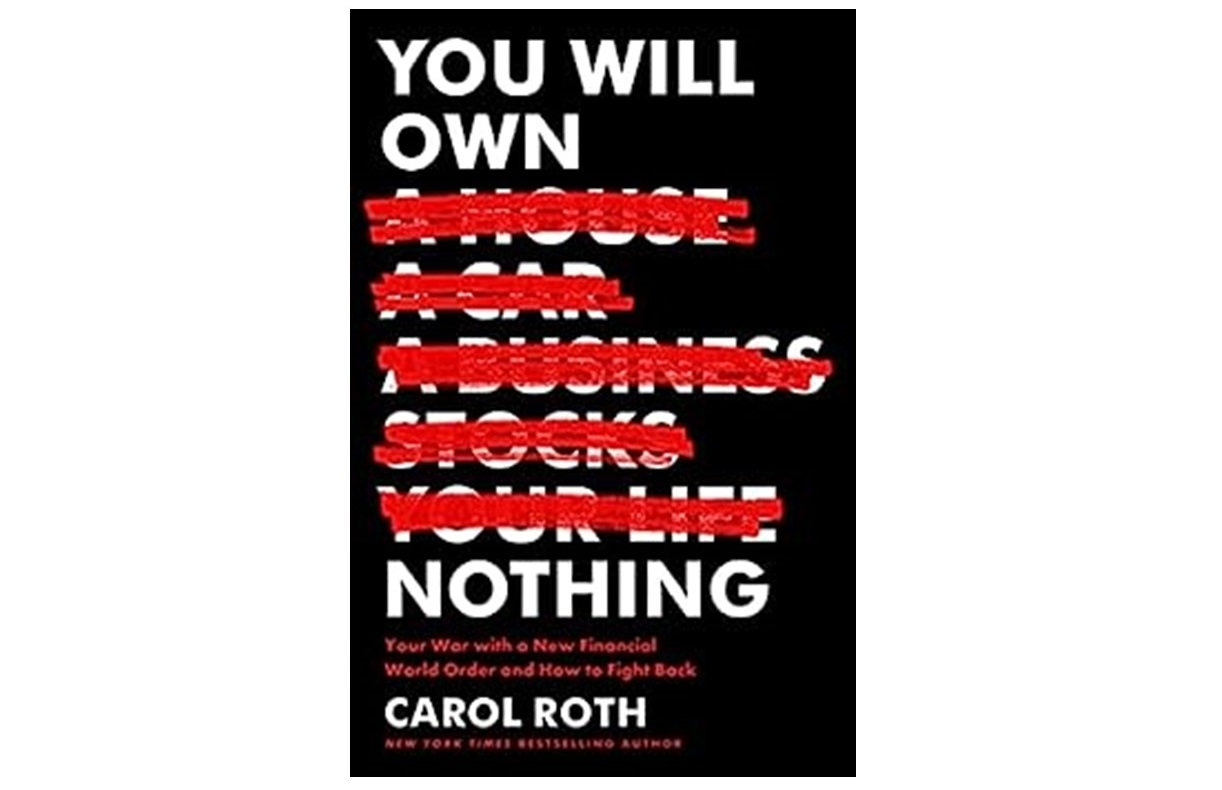

That’s my take on a recent book titled “You Will Own Nothing. Your War with a New Financial World Order and How to Fight Back.” The author is an entrepreneur named Carol Roth.

Her extensively footnoted 347-page book outlines countless conditions, present and prospective, that figure to make financial life tough for younger Americans.

It is tougher than ever to own a home, buy a car, build a business, and finance a college education.

There is a chapter on how to “fight back,” but it is unconvincing. Still, I will pass along some of its better ideas further below.

First consider this perfect storm of stressful financial factors.

Housing is the most obvious culprit. Soaring mortgage rates are the U.S. Federal Reserve’s response to inflation. Which in turn was prompted by the Fed’s own reckless printing of money during the Covid pandemic.

—

Who saw that coming?

Historians say some of the world’s great empires have crumbled because of inflation of their own currency. Rome fell after Nero called in all the silver coins and melted them down, then re-issued coins with more copper and bronze.

A generation of young folks won’t enjoy affordable home ownership like their parents did. And owning property is essential to getting ahead, says Roth.

She quotes historical figures like economist Milton Friedman, who often linked private property ownership to individual freedom; and Ayn Rand, author of “Atlas Shrugged.”

“Without property rights” said Rand, “no other rights are possible.”

Millennials face a piling on of lousy circumstances. College tuition costs are approximately triple what they were in 1998, after adjusting for inflation.

Big banks got out of the student loan business 20 years ago. When the U.S. government began guaranteeing repayment of the loans, college costs were off to the races.

Underwriting of those loans went out the window. Suddenly students could borrow whatever they wanted, within generous limits, and use the funds for whatever they pleased. Such as a spring break trip to Daytona.

The big beneficiaries have been the colleges, with multi-billion-dollar endowments now full of cash. Harvard, says Roth, is “a hedge fund masquerading as a university.”

It is all supported by a system that says, “Education is good.” But now there are college graduates with five-figure annual incomes and six-figure debts. They are begging their legislators for student loan forgiveness.

It is reminiscent of the housing bubble that began two decades ago, fueled by predatory lending and bad loans. Clearly the borrowers then, like now, bore much of the blame. But the government is the most predatory lender of them all.

—

The book’s title (“Own Nothing”) stems from a set of predictions about life in the year 2030, published in 2016. They’re from an organization called the World Economic Forum.

One prediction described a utopian world. “You’ll own nothing. And you’ll be happy. Whatever you want, you’ll rent.” Scientists and engineers will have “cracked” clean energy. We’ll all eat less meat.

That world will embrace an array of environmental, social, and corporate governance (ESG) concerns. But ESG is a “money grab,” says Roth.

As I read her take, ESG is an excuse for companies to ignore shareholder interests and even corporate profits in favor of progressive causes like green energy.

She is fearful of a world where big government is a partner with Big Tech. When Facebook can monitor your political views, the Feds can shut down your ability to spend money, buy a hamburger, or rent a self-driving car.

It incorporates an elaborate system of “social credit.” You’ll gain or lose ability to function in society, according to your opinions and thoughts.

It may sound far-fetched. But the WEF has a $300 million annual budget with support from more than 1,000 member companies. Board members include billionaires and corporate leaders from around the globe. Its famous invitation-only gathering of heavyweights happens every January in Davos, Switzerland.

The book does offer some “fight back” advice:

If younger Americans can’t own a house, they should be sure to own something. Invest in stocks, precious metals, even cryptocurrencies. When negotiating compensation from an employer, ask for a piece of the company.

That’s easier in a public company with free-trading shares. But a well-run private company can create the same sort of benefit.

The best advice, I would say, is don’t buy the “own nothing, be happy” B.S. Wealth entails ownership. It’s one thing to be young and a free spirit. Quite another to be old and broke. Those who say otherwise are already rich.